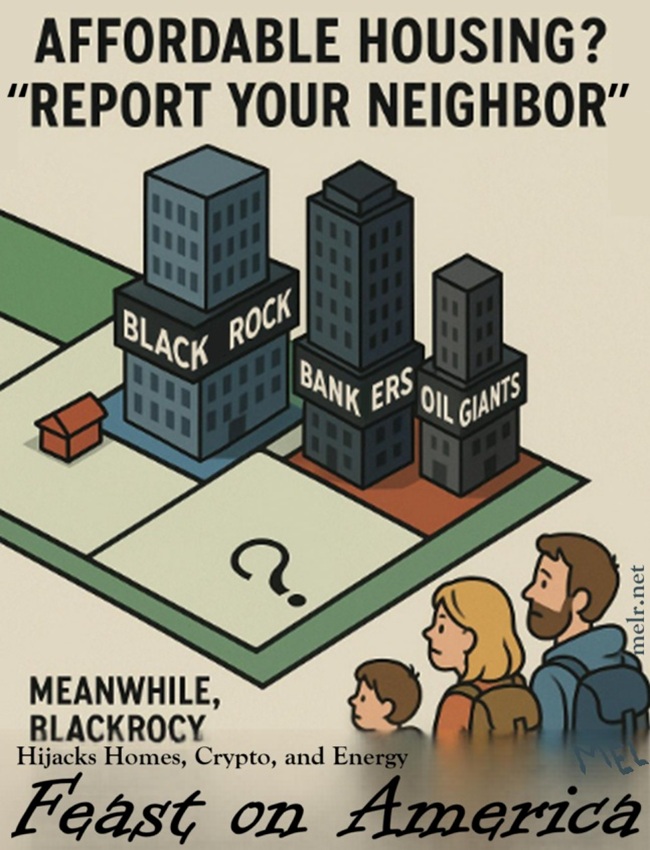

Scapegoats Distract, BlackRock Devours: The True Housing Enemy and Colonization of Crisis

While DHS distracts the public with scapegoat scripts about immigrants, the real culprits of America’s housing crisis are busy reshaping the global financial order. Their name is BlackRock — the world’s largest asset manager, a behemoth with tentacles in housing, crypto, and now oil.

This week, investors yanked a record $523 million from BlackRock’s flagship bitcoin ETF. Yet even in retreat, BlackRock is plotting expansion. Their own report warns that U.S. federal debt will swell beyond $38 trillion by 2026, a storm of fragility that they intend to ride like a wave. Instead of bonds, they see digital assets replacing traditional safe havens. Bitcoin ETFs have already gathered around $100 billion in allocations, becoming a top revenue source. Sovereign funds — entire nations — are quietly buying bitcoin through BlackRock’s channels.

This is not innovation. It is colonization. Housing, crypto, oil — every sector becomes a battlefield where BlackRock positions itself as the overlord. They are not solving crises; they are monetizing them.

Consider housing. Prices remain sky‑high, not because immigrants are “stealing homes,” but because corporations like BlackRock treat homes as speculative chips. They buy entire neighborhoods, squeeze supply, and inflate rents. The average American family is not bidding against their neighbor — they are bidding against a trillion‑dollar asset manager.

Now add oil. Infrastructure investors including BlackRock, Brookfield, and Apollo are circling major oil and gas companies, sensing opportunity in lower prices. While public investors hesitate, these giants swoop in to consolidate control. Energy, like housing, becomes another lever of dominance.

The venom is clear: BlackRock thrives on instability. Debt storms, housing shortages, energy crises — these are not problems to them, but profit engines. Every vulnerability in the system is a new revenue stream. And while DHS tells you to report your neighbor, BlackRock is quietly buying your future.

Affordable housing will never come from scapegoating immigrants. It will never come from ignoring the trillion‑dollar shadow landlords. It will only come from dismantling the financial stranglehold of companies like BlackRock, who see every crisis as a feast.

The real culprits wear suits, not backpacks. They sit in boardrooms, not border crossings. And until America faces that truth, the dream of affordable housing will remain hostage to the empire of BlackRock.

Author: Mel Reese

EMAIL ADDRESS:

melreese72[at]outlook[dot]com

While DHS distracts the public with scapegoat scripts about immigrants, the real culprits of America’s housing crisis are busy reshaping the global financial order. Their name is BlackRock — the world’s largest asset manager, a behemoth with tentacles in housing, crypto, and now oil.

This week, investors yanked a record $523 million from BlackRock’s flagship bitcoin ETF. Yet even in retreat, BlackRock is plotting expansion. Their own report warns that U.S. federal debt will swell beyond $38 trillion by 2026, a storm of fragility that they intend to ride like a wave. Instead of bonds, they see digital assets replacing traditional safe havens. Bitcoin ETFs have already gathered around $100 billion in allocations, becoming a top revenue source. Sovereign funds — entire nations — are quietly buying bitcoin through BlackRock’s channels.

This is not innovation. It is colonization. Housing, crypto, oil — every sector becomes a battlefield where BlackRock positions itself as the overlord. They are not solving crises; they are monetizing them.

Consider housing. Prices remain sky‑high, not because immigrants are “stealing homes,” but because corporations like BlackRock treat homes as speculative chips. They buy entire neighborhoods, squeeze supply, and inflate rents. The average American family is not bidding against their neighbor — they are bidding against a trillion‑dollar asset manager.

Now add oil. Infrastructure investors including BlackRock, Brookfield, and Apollo are circling major oil and gas companies, sensing opportunity in lower prices. While public investors hesitate, these giants swoop in to consolidate control. Energy, like housing, becomes another lever of dominance.

The venom is clear: BlackRock thrives on instability. Debt storms, housing shortages, energy crises — these are not problems to them, but profit engines. Every vulnerability in the system is a new revenue stream. And while DHS tells you to report your neighbor, BlackRock is quietly buying your future.

Affordable housing will never come from scapegoating immigrants. It will never come from ignoring the trillion‑dollar shadow landlords. It will only come from dismantling the financial stranglehold of companies like BlackRock, who see every crisis as a feast.

The real culprits wear suits, not backpacks. They sit in boardrooms, not border crossings. And until America faces that truth, the dream of affordable housing will remain hostage to the empire of BlackRock.

Author: Mel Reese

EMAIL ADDRESS:

melreese72[at]outlook[dot]com